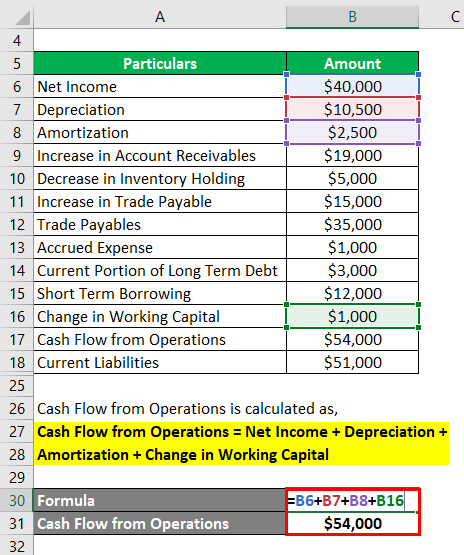

This means that we havent accounted for interest as well as taxes and their effects on the cash flow. Now, notice the fact that we are working with EBIT which is earnings before interest and taxes. Step 2 is where things get slightly complicated. This is the standard procedure we use while preparing any cash flow statement. Hence, to derive what the true cash flow of the firm is, we need to add back the depreciation amount. It has been reduced from the revenues to arrive at EBIT. Step 1: Add Back Depreciation:ĭepreciation is a non cash expense. Here is a step by step procedure to calculate the free cash flow to the firm from EBIT. If the concepts are clear, students can derive the formulas themselves as and when required.

Mindless rote learning of the formula may cause the students to forget the formulas or get confused. It is important to understand the logic behind the formulas. This article will describe this process in detail.

:max_bytes(150000):strip_icc()/dotdash_Final_Free_Cash_Flow_FCF_Aug_2020-01-b760da2ee7244a7093d6df0804bb361b.jpg)

Hence, we have to begin our calculation with EBIT and derive the free cash flow to the firm based on the supplementary information. One such example is when Earnings before Interest and Taxes (EBIT) is provided. Instead, some excerpts from these statements may be provided in the question paper.

In many cases, these financial statements may not be given in full in the question paper.

#Operating free cashflow how to#

In the previous articles, we learned about how to calculate the cash flow from operations if the cash flow statement or the income statement were given in the question paper.

0 kommentar(er)

0 kommentar(er)